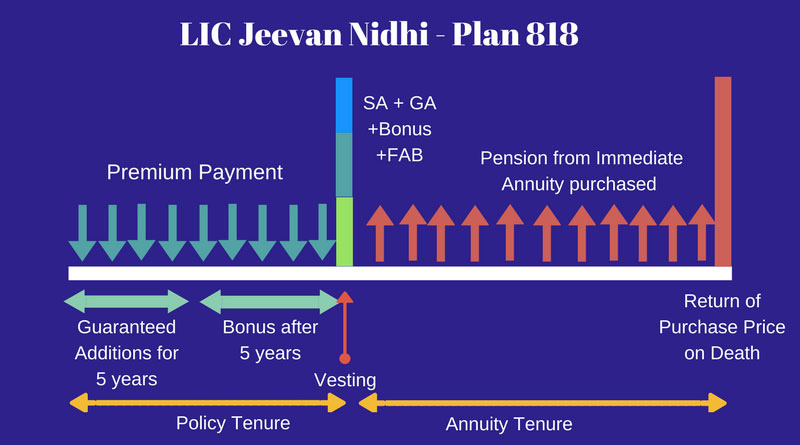

LIC’s New Jeevan Nidhi (Plan 818) is a deferred annuity with profit plan. This plan is intended to provide pension to the policy holder from the maturity proceedings available at the time of vesting. The maturity proceedings include Sum Assured, Guaranteed Additions, accrued Bonuses and Final Addition Bonuses as on the date of maturity. The customer can choose the premium paying term and vesting date as per his pension needs.

LIC NEW JEEVAN NIDHI – PLAN 818 – KEY FEATURES

- With profit deferred annuity plan with bonus and guaranteed additions.

- Guaranteed additions shall be available for the first five policy years at the rate of Rs. 50 per 1000 Sum Assured.

- Simple reversionary bonuses declared by the corporation shall get accrued in the policy from the 6th policy year.

- Maturity proceedings has to be compulsorily utilised either to purchase an Immediate Annuity plan or a new single premium deferred annuity plan.

- LIC’s accidental death and disability benefit shall be available as an optional rider.

LIC NEW JEEVAN NIDHI – PLAN 818 – DEATH BENEFIT

Death during first five policy years: Provided the policy is in full force, Basic Sum Assured + Accrued Guaranteed Additions shall be paid as lump sum amount or in the form of Annuity as per the choice of the nominee.

Death after first five policy years: Provided the policy is in full force, Basic Sum Assured + Accrued Guaranteed Additions + vested simple reversionary bonuses + final additional bonuses (if any) shall be paid as lump sum amount or in the form of Annuity as per the choice of the nominee

Nominee can opt for partly lump sum(commutation) and balance as annuity also in both the above mentioned cases.

LIC NEW JEEVAN NIDHI – PLAN 818 – MATURITY BENEFIT / VESTING BENEFITS

For in force policies, at the time of vesting, an amount equal to the Basic Sum Assured, along with accrued guaranteed additions, vested simple reversionary bonuses and final addition bonus (if any) shall be made available to the life assured.

The proceeds available on vesting shall be utilized as per the following three options.

- Withdraw 1/3rd of the entire proceeds (tax free) and then purchase an Immediate Annuity Plan from the remaining amount at the prevailing annuity rates.

- Buy an Immediate Annuity Plan from the entire amount at the prevailing annuity rates with a premium rebate of 3%.

- Buy a Single Premium Deferred Annuity Plan with a premium rebate of 3%.

One thing to remember is that the new plan can be purchased from LIC of India only.

LIC NEW JEEVAN NIDHI – PLAN 818 – PREMIUM AND BENEFIT CALCULATOR

You can use Jeevan Nidhi – online premium and benefit calculator to get a clear idea on the premium and benefit details of the plan as per the data provided by you. Click the button given below to open the calculator.

LIC JEEVAN NIDHI – PLAN 818 – ELIGIBILITY CONDITIONS AND RESTRICTIONS

| LIC’s Jeevan Nidhi – Eligibility conditions | ||

|---|---|---|

| Condition | Minimum | Maximum |

| Age at entry | 20 Years (nbd) | 60 Years (Single Premium) |

| 58 Years ( Regular Premium) | ||

| Vesting Age | 55 Years (nbd) | 65 Years (nbd) |

| Deferment Period | 5 Years (Single Premium) | 35 Years |

| 7 Years (Regular Premium) | ||

| Basic Sum Assured | 1,50,000 (Single Premium) | No Limit |

| 1,00,000 (Regular Premium |

LIC’S JEEVAN NIDHI – PLAN 818 – INCOME TAX RULES APPLICABLE ON PREMIUM AND BENEFITS.

- Premiums paid under Jeevan Nidhi plan is exempted from Income tax under Section 80 C of income tax act.

- Up to 1/3rd of the maturity proceeds (Commutation Amount) is exempted from Income tax under Section 10(10A) of Income tax act.

- Pension amount obtained from immediate annuity or deferred annuity will be taxable as it is treated as income.

LIC’S JEEVAN NIDHI – PLAN 818 – EXAMPLE OF BENEFITS

Let us consider the example of a person taking LIC’s Jeevan Nidhi plan to understand the benefits of the plan at depth. Let the details of the life assured be as follows.

| Details considered for the example – Jeevan Nidhi Plan | |||

|---|---|---|---|

| Age of Life Assured | 35 Years | Vesting Age | 55 Years |

| Sum Assured | 10,00,000 | Double Accident Benefit | Yes |

| Premium Mode | Basic Premium | GST | Total Premium |

| Yearly | 51528 | 2319 | 53847 |

Details of the plan given below are as per the example shown above and if you want to get customised details of the plan with your own details, please use the Premium and benefit Calculator.

The pension available shown is as per the pension rates of Jeevan Akshay VI, which an immediate annuity plan, open for sale from LIC of India. The annuity option considered is ‘Pension for life with return of purchase price.’

Note* The benefits under Jeevan Nidhi plan shown here are just indicative and the actual benefits may vary based on the actual experiences of the corporation. Bonus rates used for the presentation are the declared bonus rates of a similar plan (LIC Jeevan Nidhi Table 169).