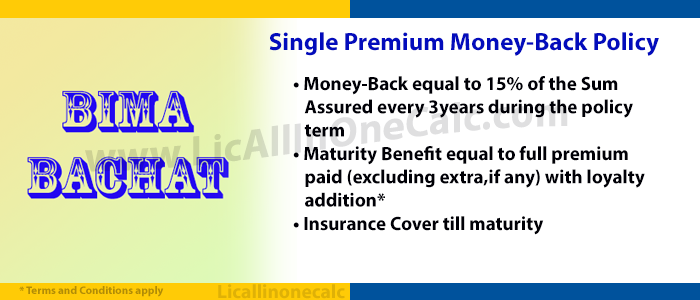

LIC’s New Bima Bachat is a participating non-linked savings cum protection plan, where premium is paid in lump sum at the outset of the policy. It is a money-back plan which provides financial protection against death during the policy term with the provision of payment of survival benefits at specified durations during the policy term. In addition, on maturity, the single premium shall be returned along with Loyalty Addition, if any.• Minimum Basic Sum Assured: Term 9 year then 35,000 and if Term 12 year then 50,000 and if Term 15 year then 70,000

• Maximum Basic Sum Assured: No Limit

• Policy Term: 9 Year or 12 Year or 15 Year

• Minimum Entry Age: 15 years (completed)

• Maximum Entry Age:Term 9year then 66year (Nearest Birthday) and if Term 12year then 63year (Nearest Birthday) and if Term 15year then 60year (Nearest Birthday)

• Maximum Age at Maturity for Life Assured: 75 years

• Mode of Premium Payment: Single Premium

LIC’s Bima Bachat Benefit Details

• On Death During 1st five policy years : Sum Assured only.

• On Death After completion of five policy years: Sum Assured + Loyalty Addition, if any.

• On Survival :

• For Policy Term of 9 years : 15% of SA, after 3rd & 6th policy year.

• For Policy Term of 12 years : 15% of SA, after 3rd ,6th & 9th policy year.

• For Policy Term of 15 years : 15% of SA, after 3rd ,6th,9th & 12th policy year.

• At Maturity Time : Single Premium Paid + Loyalty Additions, if any.

• Surrendered Value: The Policy can be surrendered at any time during the policy term subject to realization of the premium cheque.

• Loan : Loan Facillity is available under this plan, after completion of one policy year.

• Income Tax Benefit: Premium paid under this plan is eligible for TAX rebate under section 80c..