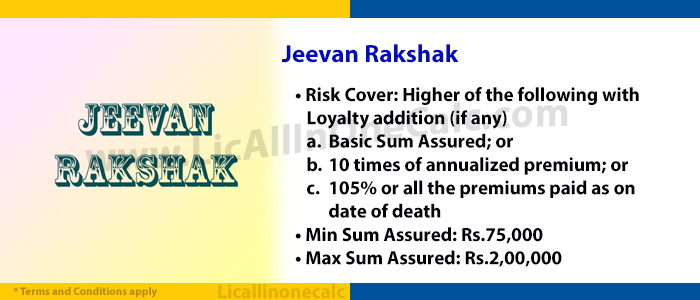

LIC’s Jeevan Rakshak Plan is a regular premium paying Non-linked, With-Profits, Endowment Assurance plan. This plan shall be available to standard lives only without any medical examination and the total Sum Assured under all the policies issued to an Individual under this plan shall not exceed Rs. 2 lacs.• Minimum Basic Sum Assured: Rs. 75,000/-

• Maximum Basic Sum Assured: Rs. 2,00,000/-

• Minimum Policy Term: 10 years

• Maximum Policy Term: 20 years

• Minimum Entry Age: 8 years (completed)

• Maximum Entry Age: 55 years (nearer birthday)

• Maximum Age at Maturity for Life Assured: 70 years

• Mode of Premium Payment: Yearly, half-yearly, quarterly & monthly

• Accidental Death & Disability Benefit Rider is available on payment of additional premium.

• Minimum entry age for the rider is 18 years.

• Minimum Accident Benefit Sum Assured is Rs 10,000

• Maximum Accident Benefit Sum Assured is an amount equal to the Basic Sum Assured subject to the maximum of Rs 1 Cr.

LIC’s Jeevan Pragati Benefit Details

• On Death befor completion of 5th policy year: “Sum Assured”

• On Death after completion of 5th policy year: “Sum Assured + Loyalty Addition if any.”

• Where ‘Sum Assured on Death’ is defined as the higher of

i. 10 times of Anualized Premium, OR

ii. 105%of all Premiums paid as on death

• On Survival : On survival Basic Sum Assured + Loyalty Addition if any.

• Surrendered Value: The Policy can be surrendered at any time during the policy term provided atleast 3 full years premiums have been paid.

• Loan : Loan Facillity is available under this plan, after payment of premiums for at least 3 full years.

• Income Tax Benefit: Premium paid under this plan is eligible for TAX rebate under section 80c.

• Maturity under this plan is free under sec 10(10D).